Research funding impact is a critical factor that shapes the landscape of innovation and economic growth in the United States. As federal funding for scientific research has come under scrutiny, the consequences ripple through the startup ecosystem, influencing new ventures and fostering entrepreneurship education at research universities. With significant investments translating into scientific innovation, researchers and aspiring entrepreneurs rely on these funds to bridge the gap between laboratory discoveries and marketable products. This dynamic ecosystem not only fuels individual startups but also serves as a catalyst for broader U.S. economic growth. Understanding the importance of research funding is essential for preserving the pipeline of new ideas that drive our economy forward.

The influence of funding for research initiatives profoundly affects the trajectory of technological advancement and entrepreneurship. Often termed as the backbone of the startup ecosystem, these financial resources bolster the profiles of universities that incubate future leaders and innovators. By supporting scientific endeavors, federal funding not only accelerates the pace of discovery but also fosters an environment ripe for entrepreneurship education. The correlations between funding, innovation, and economic stability highlight how critical these investments are to the success of emerging ventures. Ultimately, addressing the challenges posed by funding freezes will be vital in ensuring sustained growth and ingenuity across various sectors.

The Crucial Role of Research Funding in U.S. Innovation

Research funding serves as a backbone for innovation in the United States, particularly in the startup ecosystem. It allows universities to conduct groundbreaking studies that lead to scientific advancements and technological breakthroughs. Federal funding, especially for biomedical and technological research, propels the creation of new ideas that can be translated into successful startups. As researchers uncover new findings in labs across prominent universities, they unlock the potential for commercial endeavors, emphasizing why such funding is vital for maintaining the competitive edge of the U.S. economy.

When research funding is threatened or cut, the ripple effects can significantly harm entrepreneurship. For instance, recent funding freezes at Harvard due to political disagreements illustrate how quickly the landscape can change. The predictive analytics from economists suggest a potential contraction of GDP, equating funding cuts to the economic downturn experienced during the Great Recession. This stark reality highlights that without stable research funding, the innovative spirit that drives U.S. economic growth may become stunted.

Impact of Federal Funding on Startup Success

Federal research funding is crucial not only for the generation of ideas but also for the actual viability of startups emerging from universities. The connection between funded research and entrepreneurial success is well-documented, with many successful companies having their roots in university labs. For example, large-scale funding enables research institutions to maintain top-tier facilities and attract brilliant minds. This dynamic creates a fertile ground where ideas are constantly evolving, and startups can confidently emerge with a foundation built on robust research.

Moreover, a well-funded research environment fosters collaboration between academia and the private sector, further enhancing the likelihood of startup success. When universities invest in their technology licensing offices and provide support to budding entrepreneurs, it creates a bridge to venture capitalists looking for innovative opportunities. The accessibility of federal funding makes it easier for researchers to turn innovative concepts into actionable business models, which can ultimately lead to economic revitalization and growth.

Entrepreneurship Education: Fueling Startup Growth

Entrepreneurship education plays a pivotal role in shaping the next generation of innovators within the startup ecosystem. Institutions like Harvard Business School offer comprehensive programs designed to equip students with the necessary skills to launch their ventures. Through hands-on experiences, mentorship opportunities, and exposure to real-world challenges, these programs prepare students to navigate the complex entrepreneurial landscape. As more students engage in entrepreneurship curricula, the potential for new and diverse startups continues to thrive.

The richness of entrepreneurship education not only cultivates individual skills but also promotes a culture of innovation within universities. This environment encourages collaboration among students and faculty, leading to the genesis of countless startup ideas. Initiatives that connect students to venture capitalists and industry leaders further amplify this ecosystem, demonstrating that well-structured educational programs can be a powerful determinant of entrepreneurial success.

The Interplay Between Federal Funding and Entrepreneurship Education

Federal funding significantly influences the quality and extent of entrepreneurship education available in universities. When governments allocate resources to research and education, they indirectly support the growth of entrepreneurial programs. A well-funded university can invest in experienced faculty, cutting-edge technology, and unique mentoring opportunities, which collectively enhance student learning outcomes. This wealthy academic environment serves as a breeding ground for aspiring entrepreneurs, emphasizing the need for sustained federal support.

Additionally, the symbiotic relationship between research funding and entrepreneurship education cannot be overlooked. When students are educated in environments enriched by federal research dollars, they are exposed to pioneering ideas and methodologies that can lead to innovative startups. The issues arising from potential funding freezes pose a direct threat to this ecosystem, hindering not just the scientific inquiry but the overall entrepreneurial spirit fostered within these institutions.

Innovation and Economic Growth: A Cycle of Opportunity

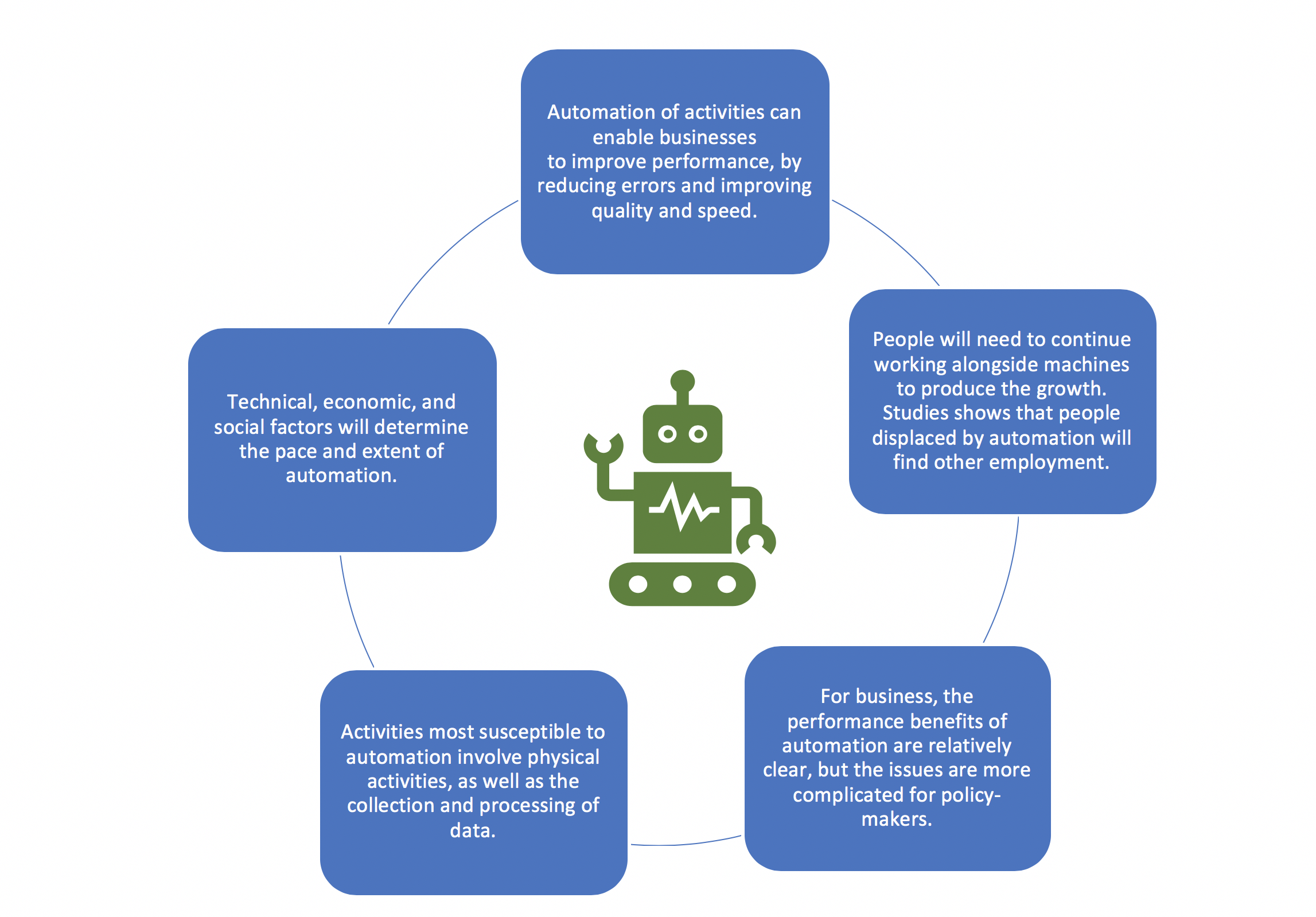

The connection between innovation and economic growth is a dynamic cycle that relies heavily on research funding. When federal funding is robust, it supports a cycle where innovation occurs, leading to the creation of startups that contribute positively to the economy. This cycle is crucial for the United States, as it positions the nation as a global leader in technology and biomedical advancements. Research institutions play a vital role in this cycle, producing knowledge that translates directly into economic prosperity.

In contrast, when research funding faces cuts, this cycle can disrupt the natural flow of innovation. As startups begin to dwindle due to a lack of robust research backing, the resultant economic stagnation can stifle job creation and investment. The long-term challenges posed by interrupted funding not only impact the immediate landscape of entrepreneurship but can also lead to broader implications for U.S. economic growth, stymying progress at multiple levels.

Long-Term Effects of Funding Cuts on Startups

The ramifications of funding cuts to research initiatives at universities extend well into the future, potentially altering the landscape of entrepreneurship for years to come. As important grants and funding streams are frozen, the immediate impact becomes evident in hiring freezes, canceled projects, and revoked grants. Unfortunately, the full repercussions may take time to materialize, as the startups poised for success today were often conceptualized and created during periods of ample funding.

Forecasting the future of entrepreneurship in the wake of funding cuts indicates a concerning decline in the number of promising startups. Consequently, the gap created by fewer innovative companies may result in slower economic growth. This delayed impact emphasizes the importance of consistency and predictability in federal funding, as only then can the U.S. maintain its competitive edge and continue to encourage vibrant innovation.

Navigating the Startup Ecosystem Post-Funding Freeze

As the startup ecosystem navigates the uncharted waters following funding freezes, strategic adjustments will be necessary to retain entrepreneurial momentum. In a climate where access to traditional funding sources is dwindling, startups will need to explore alternative financing options and innovative business models. This shift will likely require collaboration between academic institutions, private investors, and established companies willing to support the next generation of entrepreneurs.

In this transitional phase, cultivating resilience within the entrepreneurship community becomes paramount. Startups must adapt to changing circumstances, leveraging creativity and resourcefulness to thrive despite external challenges. The emphasis will shift toward harnessing intellectual capital and fostering partnerships that create synergies, ultimately paving the way for the emergence of new ventures even in a more constrained funding landscape.

The Future of Scientific Innovation and Startups

The future of scientific innovation rests heavily on the funding landscape, especially in the context of federal support. As universities continue to serve as hotbeds for research and entrepreneurship, the sustainability of this model depends on the ability to secure ongoing funding. When federal investments are committed to scientific research, it encourages universities to push the boundaries of knowledge and technology, which in turn feeds the startup ecosystem.

However, without consistent funding streams, the potential for stagnation looms large. Positioning the U.S. for significant breakthroughs in technology and medical fields requires a long-term vision supported by stable financing. By fostering an environment of scientific inquiry that translates into actionable business prospects, the U.S. can ensure a dynamic and vibrant future of innovation that fuels economic growth and global competitiveness.

Frequently Asked Questions

What is the impact of research funding on the startup ecosystem in the U.S.?

Research funding plays a crucial role in the startup ecosystem by providing the necessary resources for innovation and technology development. It supports research initiatives that lead to groundbreaking scientific discoveries and startups, ultimately driving U.S. economic growth.

How does federal funding affect scientific innovation and entrepreneurship education?

Federal funding is vital for scientific innovation as it enables research universities to create advanced technologies and educational programs. This funding not only enhances entrepreneurship education but also fosters the development of new ventures by equipping students and faculty with the tools needed to launch startups.

What role do research universities play in promoting entrepreneurship?

Research universities act as incubators for entrepreneurship by bridging academia and the startup world. They provide a rich ecosystem for students and faculty to explore commercialization opportunities, encouraging the launch of new ventures that contribute to the economy.

How does a federal funding freeze impact U.S. economic growth?

A freeze on federal funding can significantly hinder U.S. economic growth by stalling research and innovation. When funding cuts occur, the pipeline for new startups diminishes, reducing the potential for economic activity and job creation in the long term.

What are the long-term effects of cuts in research funding on startup creation?

Cuts in research funding have long-term effects on startup creation, as the incubation period for innovative ideas can take years. Decreased funding leads to fewer resources for research, resulting in a decline in the number of promising startups emerging from research institutions.

How does research funding contribute to the U.S. economy?

Research funding contributes to the U.S. economy by generating substantial economic activity for every dollar invested. It stimulates innovation in technology and medicine, leading to the creation of startups that drive economic growth and maintain the country’s competitive edge.

What are the potential consequences of reduced funding for scientific research and development?

Reduced funding for scientific research can lead to fewer breakthroughs in technology and medicine, stifling innovation. This, in turn, may decrease the number of startups emerging, ultimately hindering U.S. economic growth and reducing job opportunities.

Why is supporting research funding essential for enhancing the startup ecosystem?

Supporting research funding is essential for enhancing the startup ecosystem because it fuels the generation of new ideas and technologies. This not only helps nurture aspiring entrepreneurs but also encourages collaboration between academia and industry, which is critical for economic progression.

| Key Points | Details |

|---|---|

| Impact of Funding Cuts | Harvard faced over $9 billion in funding reviews, affecting research across the U.S. |

| Economic Consequences | Potential 3.8% contraction in GDP due to funding cuts, similar to the Great Recession. |

| Startups and Innovation | Research universities incubate startups; cuts threaten commercialization and innovation. |

| Entrepreneurial Pathways | Faculty and student-led research ties into startup ecosystem; funding is critical. |

| Long-Term Effects | Startup creation pipeline delays; effects of funding freeze will manifest over time. |

| Possibility of Recovery | It could take 1 to 3 years for research innovations to recover and access funding. |

Summary

Research funding impact is critical for fostering innovation and growth in the U.S. economy. Cuts to research funding at institutions like Harvard pose significant risks to the growth of startups and the ecosystem that supports them. As this funding freeze leads to fewer resources for research and development, the repercussions on budding entrepreneurs and technology advancements may take years to fully emerge. It is imperative that we understand the long-term consequences and work towards restoring and revitalizing research funding to safeguard America’s innovative edge.